How To Plan Your Company’s Financial Future at Every Stage of Its Lifecycle

Whether you are a new owner manager or have run your own business for years, it is wise to bear in mind the key stages it will pass through and understand how the right advice, as you plan for each transition, will ensure that you meet your financial objectives.

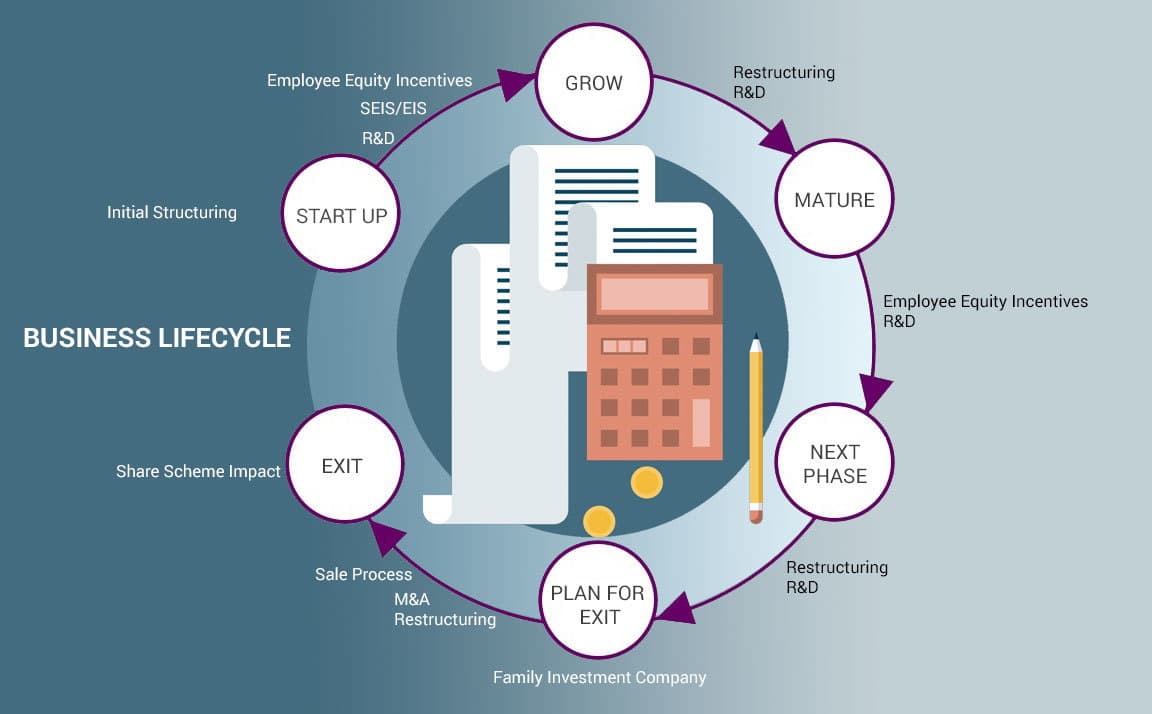

Though the terminology may change a little depending on which side of the Atlantic you’re from, the key phases in the life of a business are generally considered to be start-up, growth, maturity, next phase, and preparing for exit (see diagram). These apply to all businesses whether it is a small retail shop or a department store, an estate agency, or a software developer.

And each of these stages brings with it its own unique challenges, especially when it comes to minimising tax risk, among other things.

Start-up

Before you start a business, you need to be realistic about how much money you’ll need to get up and running. Start-up costs can include inventory, office space, equipment, anticipated tax costs and employee payroll. Being passionate about something — owning a restaurant, beauty salon, technical service, or construction company — is not enough on its own to guarantee success. The length of time it takes to start a business often depends on the type of business and the location. If it is just one person and no loans are required, it could take as little as a month or two to get started. If it is a larger company with employees and start-up funding is required, it could take up to a year to get the business off the ground.

During the first stage, it’s important to get the right advice so you don’t end up paying for mistakes later.

Things you need to consider are the structure of the business, like the number of shareholders and what rights they have regarding operations and profits. Plus the assets of the company – including any property it owns – may have an impact on your tax situation. See more on property structuring here.

At Richardson Swift we can help right from the start of your business to make sure it is set up in the most tax efficient way and that its assets are protected as much as possible from unnecessary charges. Find out more about incorporating your company.

Growth

Once your business has established a customer base and become known for a product or service, you can focus on ways to grow your sales and operations.

During a growth stage, your business may begin to make more money, breaking even, becoming profitable or increasing profitability. If your product or service is taking off, it could be time to look for more funding from investors so you can expand your business.

At this stage the right help will ensure that you could attract new investors with shares that meet the EIS and SEIS tax reliefs available to private individuals resident in the UK. This will reduce the initial net cost of their investment and so make it more likely they will support the company. Find out more about tax incentives for investors.

You may use the new funds to invest in equipment or hire more employees to expand your best-performing products or services. It may also be time to discontinue or try to improve the products or services that haven’t been selling well.

It’s worth bearing in mind that if you decide to investigate ways of developing your products, you may be able to take advantage of tax relief for research and development For details on tax relief on research and development click here.

Maturity

After several years in business, your company should hit the maturity stage, where it’s more stable and profitable. This is the third stage (above) in the life cycle of a business.

When you first started your business, you may have taken a limited remuneration. Now, as an owner, you can most likely start taking a regular salary from the company.

Mature businesses should have strong brand recognition and a secure or growing customer base that allows them to expand product lines into new or existing markets. You might want to think about taking advantage of tax relief for research and development again. More on R&D tax relief.

At this point you might want to think about introducing employee equity incentives through share schemes or employee ownership trusts etc. You might also want to think about increasing your own remuneration and benefits as tax efficiently as possible.

Now it’s vital to get the right advice. There are many ways an owner manager can take income from a successful business, some more tax efficient than others.

Next Phase

This represents the challenges and opportunities you and your business will face once it is established.

For some businesses, a larger competitor moving in nearby or a slowing desire for their product or service could result in declining sales. When you’re faced with these threats, you need to figure out how to retain and attract customers.

But it can also be a period of increased growth. Once your business becomes well-known, you may have opportunities to partner with much larger companies or groups of customers. Before taking on a large order from a bigger company or national chain store, make sure you can meet the demand in addition to your other orders coming in. When a small company gets a big break by landing a huge order, it can be an opportunity for growth and increase awareness about your company. Conversely, if you are unable to meet the demand, it could damage your reputation and business.

With your long-term goals in mind, you may want to sit down with your accountant to put together a tactical plan to guide your immediate responses during a transition. See our feature on tax efficient ways to reorganise your business, here.

Setting goals now and a structure for dealing with decisions that might be on the horizon will make sure you don’t agree to anything that you live to regret. Each of these solutions can help you achieve those

Planning Your Exit

It may be that you can never imagine a time when you would be prepared to hand over the reigns of your business to another entity, but at some point, we all have to accept that we can’t go on for ever.

Planning for your exit sooner rather than later means you can relax knowing that you have a tax efficient plan in place that will mean you get the maximum benefit out of your years of hard work.

You may also want to sell the entire business or retain partial ownership and receive income from the business’s profits even though you’re no longer involved with the day-to-day operations. Some business owners agree to stay on and help train the new owner during the transition. For more information see our guide to Selling Your Business here.

For small or medium-sized business owners, a successor is often a family member, friend or current employee who wants to take over and run the business.

There are several ways that the right advice can make this process easier and more tax efficient, for instance, you might feel that a Family Investment Company is the way to go. This enables you to plan to hand over control of your business in the future to adult children while gradually reducing exposure to IHT. Find out more about Family Investment Companies.

If you are planning to sell, there is a whole process you should go through with your tax adviser or accountant to make sure you set the right price for your company and that it’s tax efficient. Download this article by RS director Jon Miles for more information.

As owner manager specialists, we can advise on the best way to prepare for every part of your business lifecycle and, importantly, how best to manage your personal tax situation and that of your family, alongside that of your business.

We advise on the full range of tax matters for companies and can also assist individuals with optimising their tax relief. Depending on your needs we can navigate your way through complexities.

Click here to book a free initial consultation with tax director Jon Miles to discuss how RS can help you plan for both your business and you. Or contact Jon on 01225 325580 or jm@richardsonswift.co.uk

"As owner manager specialists, we can advise on the best way to prepare for every part of your business lifecycle."

Jon Miles

Director